Homeowner Assistance Fund (HAF) Software

All-in-one solution to manage Homeowner Assistance Funds

Single vendor HAF management

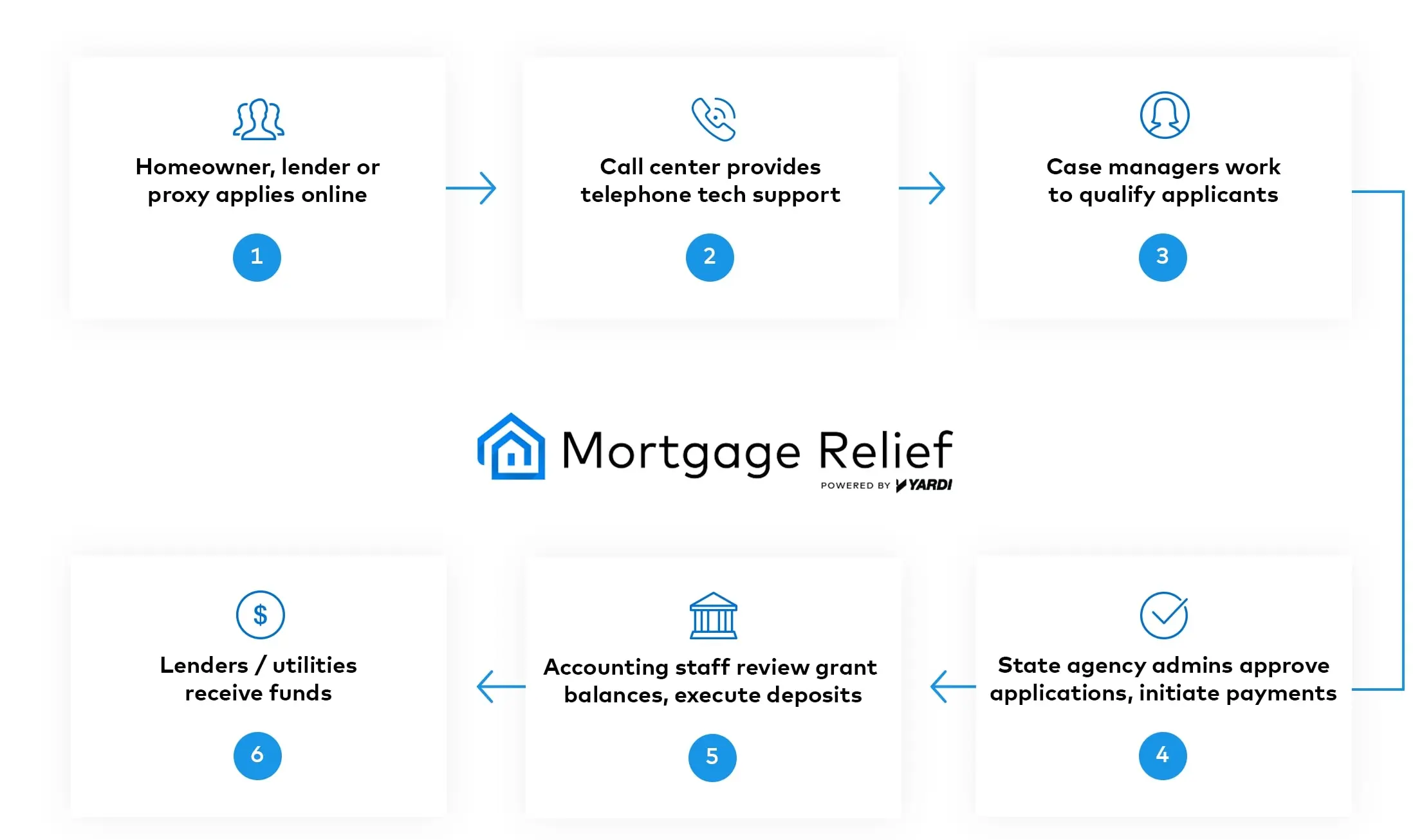

Mortgage Relief centralizes four core HAF components into one platform:

Application Portals

Online access for homeowners, homeowner representatives and loan servicers and seller/owner financed lenders

Common Data File (CDF) integration

Built-in language translation

Mobile-friendly and based on mature & proven technology

Call Center

Built-in call center dashboard

Available to in-house or third-party call center staff

Optional Yardi call center service

Case Management

Built in case management platform

Available to in-house or third-party case management staff

Optional Yardi case management service

Payment Distribution

Built-in funding dashboard

Native payment processing engine

Efficient transfer of funds within 24 hours of approval

Based on mature and proven service: $1.8B in yearly payment transfers

The benefits of Mortgage Relief

Transparency

View funds available, disbursed and in-process at any time

Detect and act on fraud before payments are made

Simplify reporting with complete compliance data on demand

Efficiency

Provide mobile access for homeowners, homeowner reps, loan servicers and seller/owner financed lenders

Create collaborative opportunities between regional agency partnerships

Expedite staff proficiency with online training content

Minimize impact on IT hardware or staff resources with a cloud-based solution

Simplicity

Get everything you need for HAF from a single vendor

Save time on training, implementation, configuration and program management

Scale solution components based on your organizational requirements

Our team of professionals are here to help you manage available funds for your jurisdiction

Schedule a demo

FAQ

The American Rescue Plan Act of 2021 (ARP) created the Homeowner Assistance Fund (HAF) to mitigate financial hardships associated with the coronavirus pandemic for the purpose of preventing homeowner mortgage delinquencies, defaults, foreclosures, loss of utilities or home energy services, and displacements.

The federal stimulus package passed in March 2021 allocated approximately $9.9 billion to homeowner assistance. HAF funds are available to certain homeowners who have experienced financial hardship after January 21, 2020.

Funds are provided directly to states, territories, and Native American tribes to administer to eligible households through homeowner assistance programs. Eligible households may receive funds for mortgage payments, utility payments and various qualified expenses.

Applications for homeowner assistance may be submitted by homeowners through programs established by grantees. In general, funds will be paid directly to mortgage holders and utility providers.

Mortgage Relief software can help state, and other grantees streamline the application, approval, distribution and audit process. Cloud-based homeowner assistance software provides the accessibility and transparency that grantees need to more effectively disburse funds to help households in need of mortgage relief.

Mortgage Relief is software built to help state and other agencies manage and distribute funds. With Mortgage Relief, homeowners can apply for mortgage assistance online and view their application status in real time. Homeowner application portals are easy to use and mobile device friendly. Loan details are verified with loan servicers through the Common Data File (CDF) or the loan servicer portal. Agencies can more efficiently process applications and distribute homeowner assistance funds.

Mortgage Relief software works from anywhere to give you complete transparency into funds available, in process and disbursed. It’s simple to use, increases efficacy and decreases fraud. Mortgage Relief improves the audit and review process with easily accessible analytics and reporting.

Yardi is pleased to support ERAP with our Rent Relief solution; Mortgage assistance with our Mortgage Relief solution; Utility assistance with our Utility Relief solution; and grant management, small business, disaster recovery, and homelessness assistance with our Core Relief Suite of products.